Expand through M&A

Creative Deal Structure, Diligence and Readiness for 7-, 8-, and 9-digit transactions.

© 2024 5thGenCFO, LLC

The M&A Conundrum

Growing companies reach a stage where Organic Growth is insufficient to maintain growth rates, so they turn to Mergers and Acquisitions.

However, 50% to 80% of Acquisitions fail to add value, depending on whose study you read. Acquisitions are critical to meet growth targets, but if most of them fail, why do it?

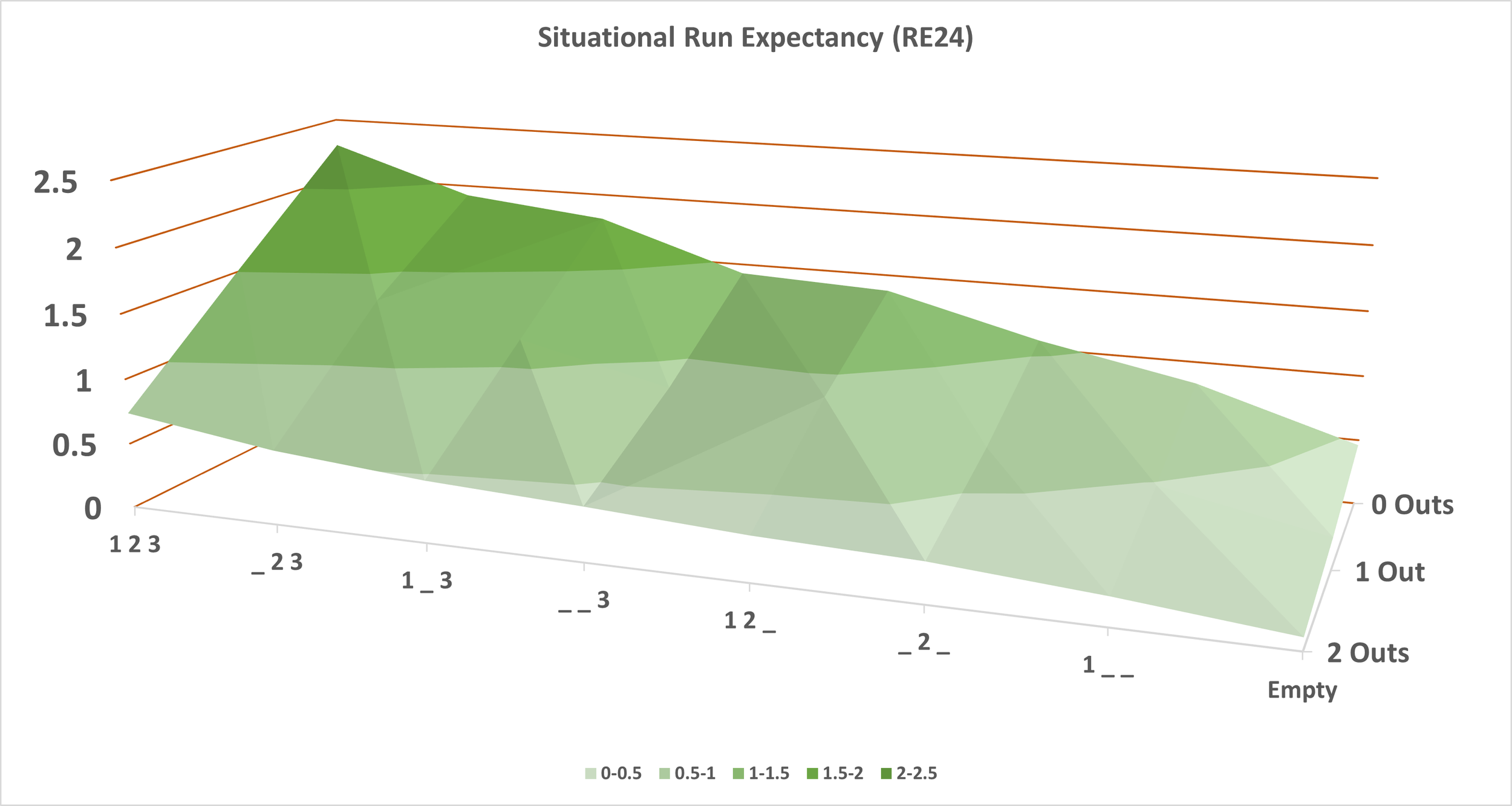

Successes compensate for failures.

In baseball, batters strike out or get thrown out more than they hit. Better hitting—not perfect hitting—wins world championships. Let 5thGenCFO improve your average through customized deal structure, buy-side diligence and sell-side readiness.

© 2024 5thGenCFO, LLC

Everything is for sale. Business owners are entertaining more pitches than ever to sell their businesses, while potential Buyers are facing a steeper cost of capital. This increases the risk to Buyers, thereby making due diligence critical to a successful acquisition for both parties. Proper due diligence involves structuring realistic, satisfactory deal points while planning for integration. Success hinges on structuring around the quantifiable while managing the emotional aspects of a transaction.

5thGenCFO helps buyers and sellers at any stage in the lifecycle of an M&A transaction. No transaction is too difficult for us to structure, and we are good at resolving counterparty and people issues, too.

95% of M&A activity involves privately-held or non-public entities.

© 2024 5thGenCFO, LLC